will capital gains tax change in 2021 uk

If you own a property with a partner you both get that personal capital gains tax allowance. So for the first 12300 of capital gain you could take that money completely tax-free.

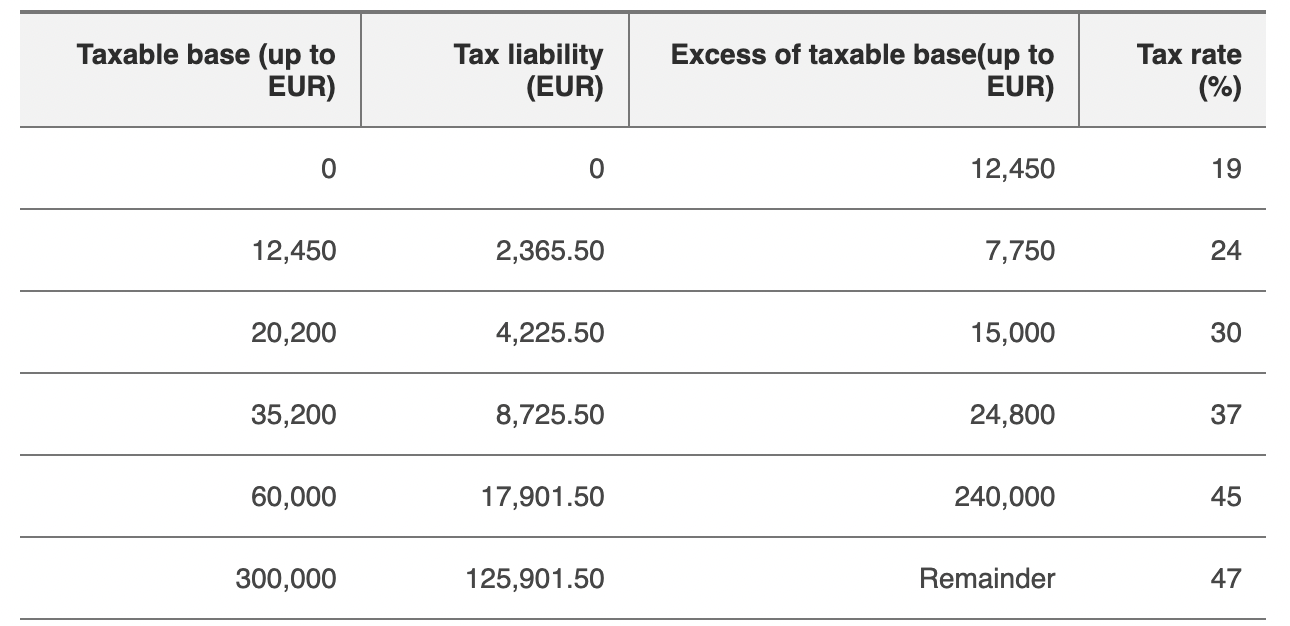

How To File An Income Tax Return In Spain Expatica

Get help dealing with the IRS on a variety of tax problems including.

. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways. HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential property which was not.

But observers believe that other taxes and reliefs will be at the forefront of new revenue raising plans in the next budget or further down the line. The Biggest Shake Up In Capital Gains Tax Ever. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

2020 to 2021 2019 to 2020 2018 to 2019. Capital Gains Tax UK changes are coming. October 29 2021.

Budget capital gains tax CGT. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Rishi Sunak could enact stealth change to CGT - act now CAPITAL GAINS TAX could be set for a stealth change in Chancellor Rishi Sunaks Budget tomorrow and one expert has encouraged Britons to consider eleventh hour action.

From 6 April 2020 if you. Before completing your taxes this year understand how capital gains tax works and how new changes affect your filing. 1448 Tue Mar 2 2021.

You can change your cookie settings at any time. 10 18 for residential property for. In other words the first 24600 of profit you can get tax-free.

The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after. With that established lets take a look at the potential changes in Capital Gains Tax that could occur in 2021 and how that might impact people and taxpayers. 0800 Fri Oct 29 2021.

Learn all about capital gains tax here. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do.

Capital Gains Tax rates in the UK for 202223. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years. Crucially Capital Gains Tax refers to the gain you make not the amount you receive for the asset.

These changes may be significant and have large ramifications for your investments. Here is everything you need to know. Capital Gains Tax Example.

While very few individuals delight in paying tax in the case of CGT there should be some cause for congratulation as this means you will have. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and CGT reform. By Temie Laleye 0749 Thu Oct 28 2021 UPDATED.

Capital gains are taxable with the tax rate depending on your income and the length of time you held the asset. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. Income tax allowance.

What Are Capital Gains Tax Rates In Uk Taxscouts. This allowance is the amount of money you can earn before. As the name might imply Capital Gains Tax CGT is paid on the gain on the sale of an asset that has risen in value.

This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax. Chancellor Rishi Sunak laid out changes to capital gains tax CGT as part of his 2021 Budget delivered on October 27. Short- and Long-Term Gains An important distinction is short-term versus long.

The second part of the report is due in 2021. CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax Simplification OTS to look at how this tax could be reformed. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

Alongside maintaining the Lifetime Allowance and Capital Gains Tax it is estimated the Treasury will raise some 204billion. One of the areas the government is looking to increase its tax collection from is capital gains. The OTS review of CGT.

One of the biggest announcements in Rishi Sunaks budget was that the tax-free personal allowance will be frozen. Each year at the moment there is a personal capital gains tax allowance. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10 12 22 24 32 35 or 37.

Capital Gains Tax warning. Non-resident Capital Gains Tax on the. In other words the tax only becomes due if that asset has risen in value and realised a profit.

The Chancellor could decide to reduce this allowance with these changes being tapered over a number of years. The federal taxing agency requires an accounting of the sale price and basis or net purchase price and in most cases will levy a tax on any gain. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

We Are High Volume Shipping Experts. CAPITAL GAINS TAX rules changed at midnight in news which has been dubbed positive for UK property owners. Capital Gains Tax changes that Self Assessment customers need to know.

1146 Tue Mar 2 2021 UPDATED. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax. Reduce the Capital Gains Tax-free allowance.

Once again no change to CGT rates was announced which actually came as no surprise. You may find yourself paying no tax at all on your capital gains when you file your return in 2021. The Capital Gains Tax annual exemption is 12300 for the year 20212022.

Taxes On Cryptocurrency In Spain How Much When How To Pay

Capital Gains Tax What It Is How It Works What To Avoid

What Are Capital Gains Tax Rates In Uk Taxscouts

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 Capital Gains Tax Rates In Europe Tax Foundation

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Difference Between Income Tax And Capital Gains Tax Difference Between

3 Capital Gains Tax Retention On Property Sales By Non Residents

Capital Gains Tax What Is It When Do You Pay It

A Complete Guide To Capital Gains Tax Cgt In Australia

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling

Difference Between Income Tax And Capital Gains Tax Difference Between

Top 8 Countries With No Income Tax That You Should Know

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Should You Move To A State With No Income Tax Forbes Advisor

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

Capital Gains Tax On Separation Low Incomes Tax Reform Group