what taxes do i pay after retirement

You reported your income by attaching a Schedule C Profit or Loss From Business Sole Proprietor and Schedule SE Self-employment Tax to your Form 1040. In 20222023 this means you can receive up to 12570 of income before you start paying income tax at 20 although your personal allowance will be lower if you earn more than 100000.

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

When you withdraw money from the retirement plan you will have to pay ordinary income taxes on those.

. The percentage amount will be calculated. You pay tax on your pension if your total annual income adds up to more than your Personal Allowance. If youre age 60 or over.

Part is tax-free made up of. If you have a Roth 401k unlike the traditional 401k your contributions are made with after-tax money. Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about 10500 a year in total income taxes federal state and.

5 And if you have an employer-funded pension plan. When you are paying taxes on retirement income on your Social Security income you will be taxed anywhere from 0 to 85. Your entire benefit from a taxed super fund which most funds are is tax-free.

Your pension provider will take off the charge before you get your payment. Employer matches your contributions to a Roth 401k are made with pre-tax dollars. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401ks 403bs and similar retirement plans and tax.

After you formally retire. If your combined income hits certain thresholds then up to. Anyone who withdraws from their 401K before they reach the age of 59 12 they will have to pay a 10 penalty along with.

Heres the different Tax Buckets Tax-Deferred AccountSavings Plan. The extra income from returning to work could bump you into a higher tax bracket meaning you have to pay higher income taxes. 8 rows 35.

For 20222023 that means if your income is over 12570. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans and tax. How much tax do I pay on 401k withdrawal at 59 1 2.

You usually pay a tax charge if the total value of your private pensions is more than 1073100. Both your income from these retirement plans and your earned income are taxed as ordinary income at rates from 10 to 37. Although Roth 401k has a few advantages you still need to pay Social Security taxes.

A tax-deferred savings plan is an investment account that allows a taxpayer to postpone paying taxes on the money. Taxes on a Traditional 401 k For the tax year 2021 for example payable on April 18 2022 a married couple who files jointly and earns 90000 together would pay 9328 plus.

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

What Are Defined Contribution Retirement Plans Tax Policy Center

California Property Tax Calculator Smartasset Com Income Tax Property Tax Paycheck

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

What To Do With A 401k After Retiring From Your Employer Investing For Retirement Retirement Advice Retirement Strategies

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Physician On Fire Has Over 80 Of His Retirement Dollars In Post Tax Accounts And Believes Those Investing For Retirement Investment Quotes White Coat Investor

Your Tax Refund How Will You Spend It Infographic Tax Refund Finance Investing Ira Investment

Napkins Napkin Finance Financial Literacy Lessons Finance Investing Infographic

Tax Withholding For Pensions And Social Security Sensible Money

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

Tax Filing Tips For Saving Money On Your Taxes Filing Taxes Free Tax Filing Tax Help

State By State Guide To Taxes On Retirees Retirement Retirement Income Tax

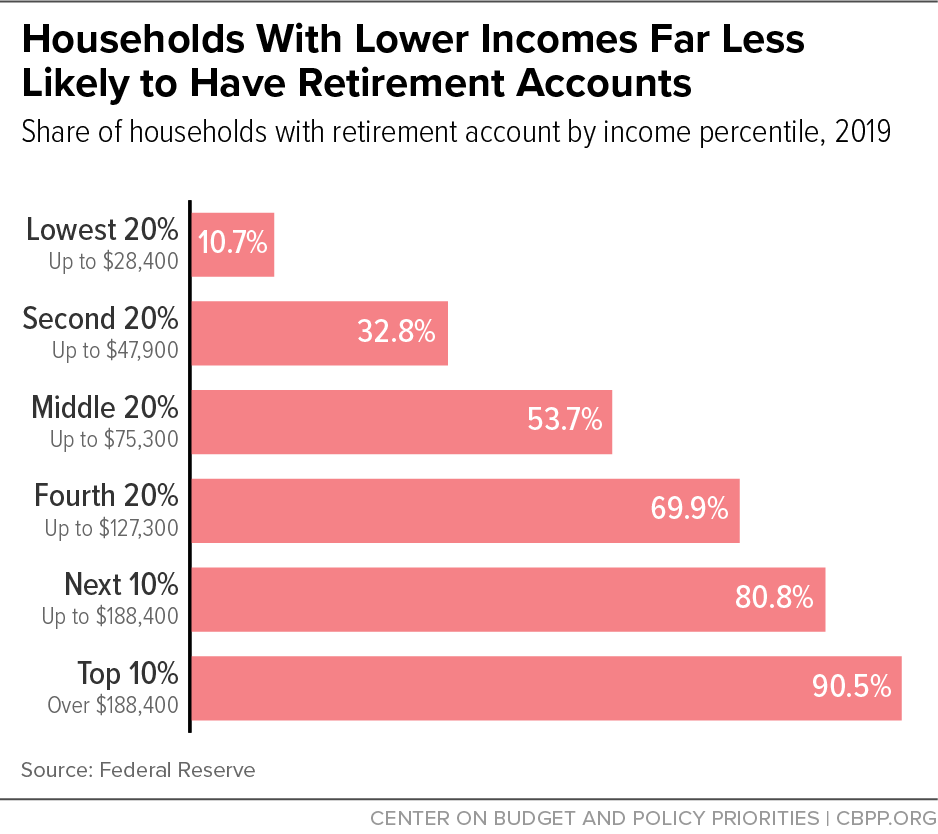

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

0mpihxsw Tax Preparation Income Tax Return Tax Return

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax